Will a tax expert be preparing your Self Assessment return this year? Here are ten good reasons why using a qualified tax professional is usually the way to go.

Saves time & hassle

A good accountant will take care of the whole process for you, from preparing the Tax Return, to filing it, on time, with HMRC, freeing up your time so you can concentrate on running your business - or spending time with the family or friends.

Expertise

Put simply: we know what we’re doing. Our team has extensive knowledge of the UK tax system, so you can rest assured that we will prepare your Tax Return to the highest standard.

Tax planning

With oversight of your personal as well as business tax affairs, we are better placed to help you structure your financial affairs tax-efficiently. So whether you are a director of your own company wondering about your dividend/salary split; a property owner paying high taxes; or a sole trader trading profitably but facing increasing tax bills, we can help.

Tax savings

Whether it’s capital allowances, employment expenses, or tax-free allowances, we can quickly identify any tax deductions, and we will automatically claim these for you if available.

Don’t miss any deadlines

We file your Tax Return by 31 January, but we also help you to meet other deadlines. Want your tax collected via your tax code, rather than pay it in one lump sum? Your Tax Return must be filed no later than 30 December.

We deal with HMRC

Who wants to spend hours on the phone trying to speak to someone at HMRC? As your agent, we have fast-tracked access to the Self Assessment helpline, so we can deal with personal taxation problems, such as correcting your tax code, promptly - so you don’t have to.

Help with HMRC enquiries

HMRC select Tax Returns for routine enquiries, and we know it can be very worrying to receive an unexpected letter saying that your Tax Return has been selected for enquiry. When we prepare your Tax Return, we can promptly attend to this for you, and provide the professional response to HMRC to conclude the enquiry as smoothly as possible.

Avoid costly mistakes

Tax is complex, and making a mistake on a Tax Return can lead to you overpaying tax. If HMRC open an enquiry into your Tax Return, and discover that you have underpaid tax, HMRC will charge penalties and late payment interest on the additional amount due, and this may span several tax years, resulting in an unexpected bill due for payment immediately.

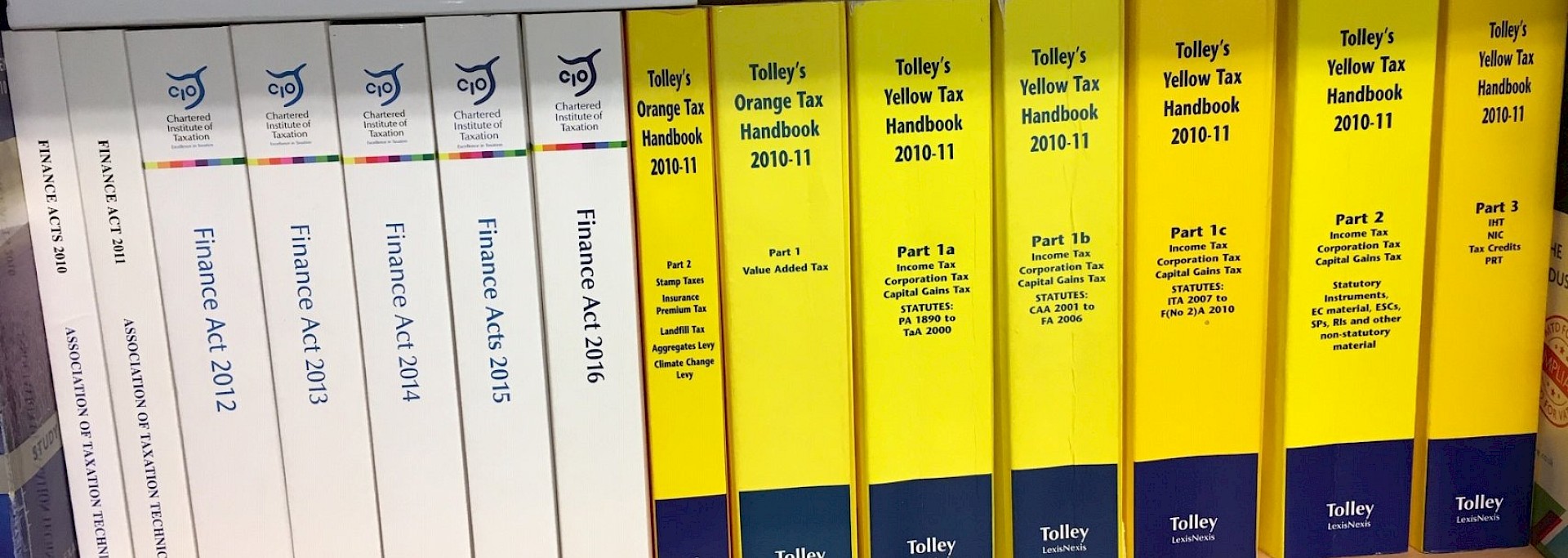

Keep informed

Tax is continually changing. New allowances come in, tax-free thresholds increase or reduce, and tax rules change as the country evolves and successive governments have different ideas about taxation. As it is, the UK tax code is the longest in the world! It can seem a minefield to navigate around, but we are very much adept at breaking down the legislation into what it means for your personal tax, and we keep up-to-date on the latest changes in UK tax, so that we are fully informed when we prepare your Tax Return.

Advice

As your accountant and tax advisers, we are always only a phone call or e-mail away. We are here to help you, and by preparing your personal Tax Return, we are better able to help you with your personal taxation queries.

For professional assistance with your 2018/19 Self Assessment return, contact Kayleigh today.

Click through to read more about our Self Assessment service. Our rates start from as little as £160+VAT.